The Rise of Quantum Computing in Financial Services

Quantum computing is revolutionizing the financial services industry by offering unparalleled computational power and the ability to solve complex problems at speeds unimaginable with classical computers. The sheer potential of quantum computing to optimize portfolio management, risk assessment, and trading strategies is reshaping the way financial institutions operate in a world characterized by rapid data accumulation and market fluctuations.

Incorporating quantum computing into financial services introduces a new era of innovation and disruption, enabling organizations to crunch vast amounts of data to uncover insights, predict market trends more accurately, and enhance security measures. Despite the challenges and high barriers to entry, the race to harness the power of quantum computing in the financial sector is intensifying, with early adopters gaining a competitive edge and unlocking unprecedented opportunities for growth and advancement.

Understanding Quantum Computing

Quantum computing operates on the principles of quantum mechanics, utilizing quantum bits or qubits that can represent both 0 and 1 simultaneously. This concept of superposition allows quantum computers to process vast amounts of data in parallel, providing exponential speedup compared to classical computers. Moreover, quantum entanglement enables qubits to be interconnected in a way that their states are linked, allowing for complex computations to be performed efficiently.

In classical computing, data is represented in bits as either 0 or 1, limiting the computational capacity. Quantum computing, on the other hand, leverages the phenomena of superposition and entanglement to manipulate qubits in a way that offers significant advantages in solving complex problems. This revolutionary approach has the potential to transform various industries, including financial services, by revolutionizing data analysis, risk assessment, and encryption methods.

Challenges and Opportunities in Financial Services

In the realm of financial services, the adoption and integration of quantum computing present a myriad of challenges and opportunities. The complexity of quantum algorithms and the scarcity of qualified experts in this field hinder the widespread implementation of quantum technology in financial institutions. Additionally, the high costs associated with acquiring and maintaining quantum computing infrastructure pose a significant barrier for many organizations in the industry.

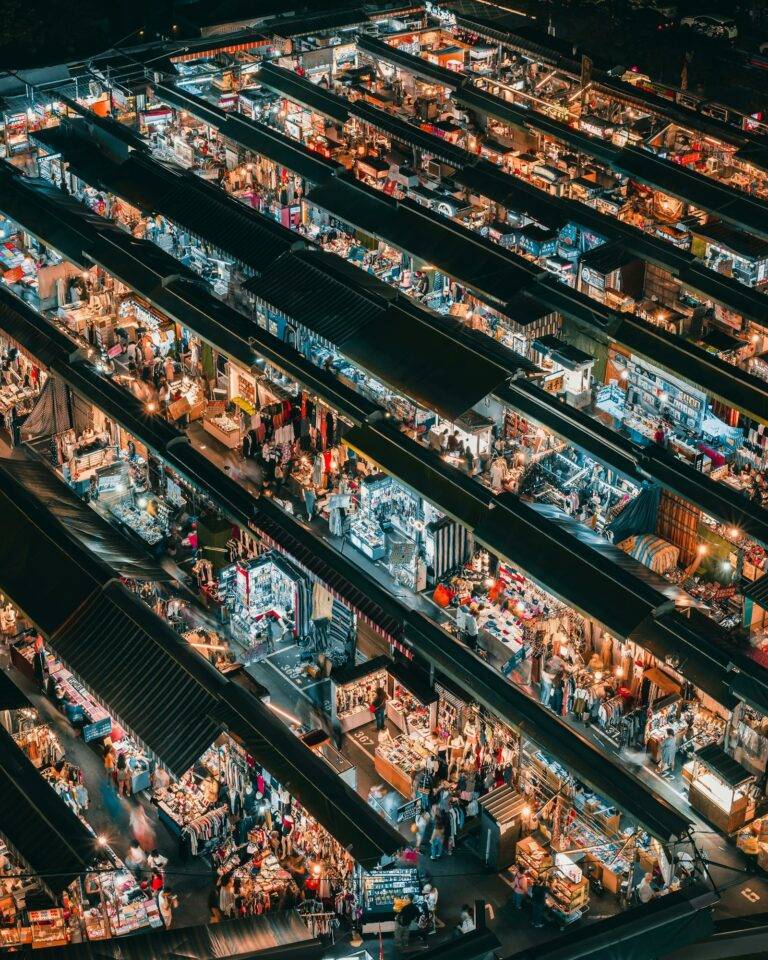

On the flip side, the opportunities that quantum computing offers in financial services cannot be underestimated. Quantum technology has the potential to revolutionize risk assessment and portfolio optimization by processing vast amounts of data at speeds unattainable with classical computing. With the ability to solve complex problems exponentially faster, quantum computing opens doors to innovative solutions in algorithmic trading, fraud detection, and personalized financial services, paving the way for enhanced efficiency and competitiveness in the sector.

• Quantum computing presents challenges and opportunities in financial services

• Complexity of quantum algorithms and scarcity of experts hinder widespread implementation

• High costs associated with acquiring and maintaining quantum infrastructure pose a barrier for many organizations

• Quantum technology has the potential to revolutionize risk assessment and portfolio optimization

• Quantum computing can process vast amounts of data at speeds unattainable with classical computing

• Exponential speed in solving complex problems opens doors to innovative solutions in algorithmic trading, fraud detection, and personalized financial services.

What is quantum computing and how does it relate to financial services?

Quantum computing is a type of computing that uses quantum-mechanical phenomena, such as superposition and entanglement, to perform operations on data. In the financial services industry, quantum computing has the potential to revolutionize various processes, such as risk analysis, algorithmic trading, and fraud detection.

What are some of the challenges faced by financial services in adopting quantum computing?

Some of the challenges include the high cost of implementing quantum computing systems, the need for specialized skills and expertise, and the uncertainty surrounding the scalability and reliability of quantum systems. Additionally, there are concerns about data security and privacy in a quantum computing environment.

What opportunities does quantum computing present for financial services?

Quantum computing offers the potential for faster and more efficient data processing, improved risk management and analysis, enhanced security measures, and the ability to solve complex problems that are currently beyond the capabilities of classical computers. It could lead to more accurate forecasting, better decision-making, and ultimately, increased competitiveness in the industry.